Industry Update

What Caused Real House Prices to Decline for the First Time in 8 months?

Written by: Mark Fleming, First American Chief Economist

First American’s proprietary Real House Price Index (RHPI) looks at April 2017 data and includes analysis from First American Chief Economist Mark Fleming on the impact of wages and lower interest rates on real house prices.

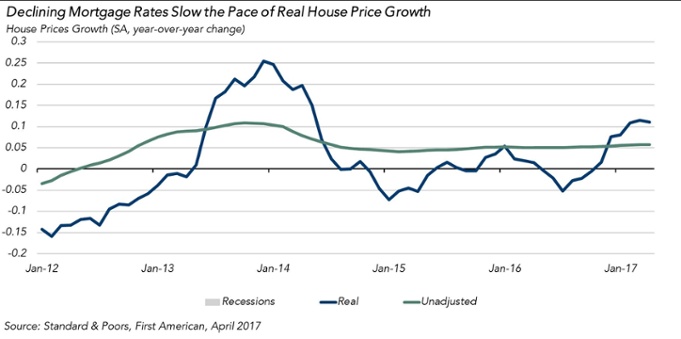

“Despite the monetary tightening policies of the Federal Reserve, a dip in the average rate for a 30-year, fixed-rate mortgage and wage gains increased consumer house-buying power sufficiently to offset the gain in unadjusted house prices. The decline in real, purchasing-power adjusted house prices between March and April was the largest month-over-month decline since July 2016,” said Mark Fleming, chief economist at First American.

For Mark’s full analysis on affordability, the top five states and markets with the greatest and smallest increases in real house prices, and more, please visit the Real House Price Index.

“The decline in real, purchasing-power adjusted house prices between March and April was the largest month-over-month decline since July 2016 and a respite from the 8-month-long trend of increasing real house prices.”

The RHPI offers an alternative view of the change over time of house prices at the national, state and metropolitan area level. The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what really matters to potential buyers - their purchasing power, or how much they can afford to buy. The RHPI adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of July 24, 2017.

Visit First American's Economic Center to read more from Mark Fleming, Chief Economist and to subscribe to his blog.