How Will Hurricanes Harvey and Irma Impact Housing Market Potential?

By: Mark Fleming, Chief Economist for First American

First American’s proprietary Potential Home Sales model examines August 2017 data and includes analysis from First American Chief Economist Mark Fleming on how the real estate market is performing versus its potential.

August 2017 Potential Home Sales

For the month of August, First American updated its proprietary Potential Home Sales model to show that:

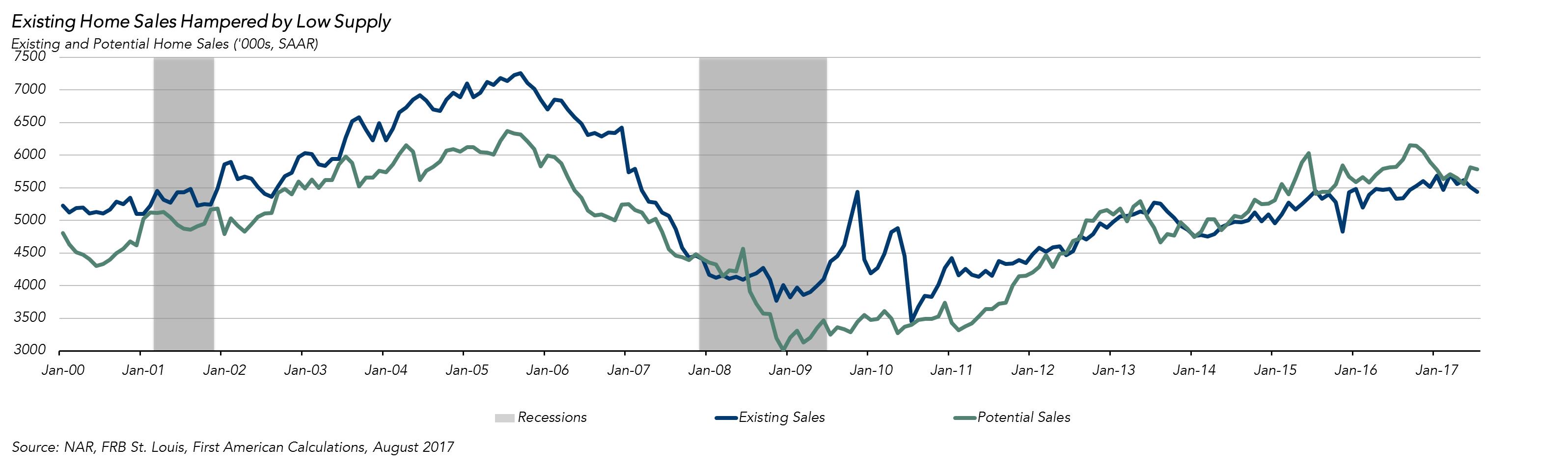

- Potential existing-home sales decreased to a 5.71 million seasonally adjusted, annualized rate (SAAR), a 1.3 percent month-over-month decrease.

- This represents an 89.9 percent increase from the market potential low point reached in December 2008.

- In August, the market potential for existing-home sales decreased by 3.7 percent compared with a year ago, a loss of 221,000 (SAAR) sales.

- Currently, potential existing-home sales is 656,000 (SAAR), or 11.5 percent below the pre-recession peak of market potential, which occurred in July 2005.

Market Performance Gap

- The market for existing-home sales is underperforming its potential by 3.6 percent or an estimated 206,000 (SAAR) sales.

- Market potential fell by an estimated 72,000 (SAAR) sales between July 2017 and August 2017.

Hurricanes Harvey and Irma Add to Housing Inventory Woes

“While, the full scope of the damage from hurricanes Harvey and Irma is still being assessed, it is clear the impact on the housing market will be considerable. The Houston metropolitan area and the impacted Florida counties alone accounted for 8.0 percent of all U.S. existing home sales in 2016. We expect existing-home sales to decrease in the short-run, as loan closings are rescheduled and some borrowers with pending contracts withdraw their bids on damaged homes. As recovery efforts move forward, the pre-hurricane shortage of construction workers will likely hamper the process of rebuilding efforts and further limit the pace of new home construction, as the limited labor supply shifts away from new home construction to rebuilding efforts.”

"Hurricanes expected to impact home sales in the short-run, as loan closings are rescheduled and some borrowers with pending contracts withdraw their bids on damaged homes."

Chief Economist Analysis Highlight

- The housing market’s potential for existing-home sales declined between July 2017 and August 2017, as home building permits, a leading indicator of future housing stock, have declined in recent months.

- The market performance gap widened as actual existing-homes sales declined in July because of increasingly tight supply. According to the National Association of Realtors (NAR), the number of homes listed for sale has declined for 26 consecutive months, dropping 9.0 percent over the past 12 months.

- The combination of home price appreciation driven by inventory shortages and the rise in mortgage rates over the prior year has had a meaningful impact on affordability. According to the First American Real House Price Index, affordability is down 9.3 percent in July compared to a year ago.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That’s difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what home sales should be based on the economic, demographic, and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.